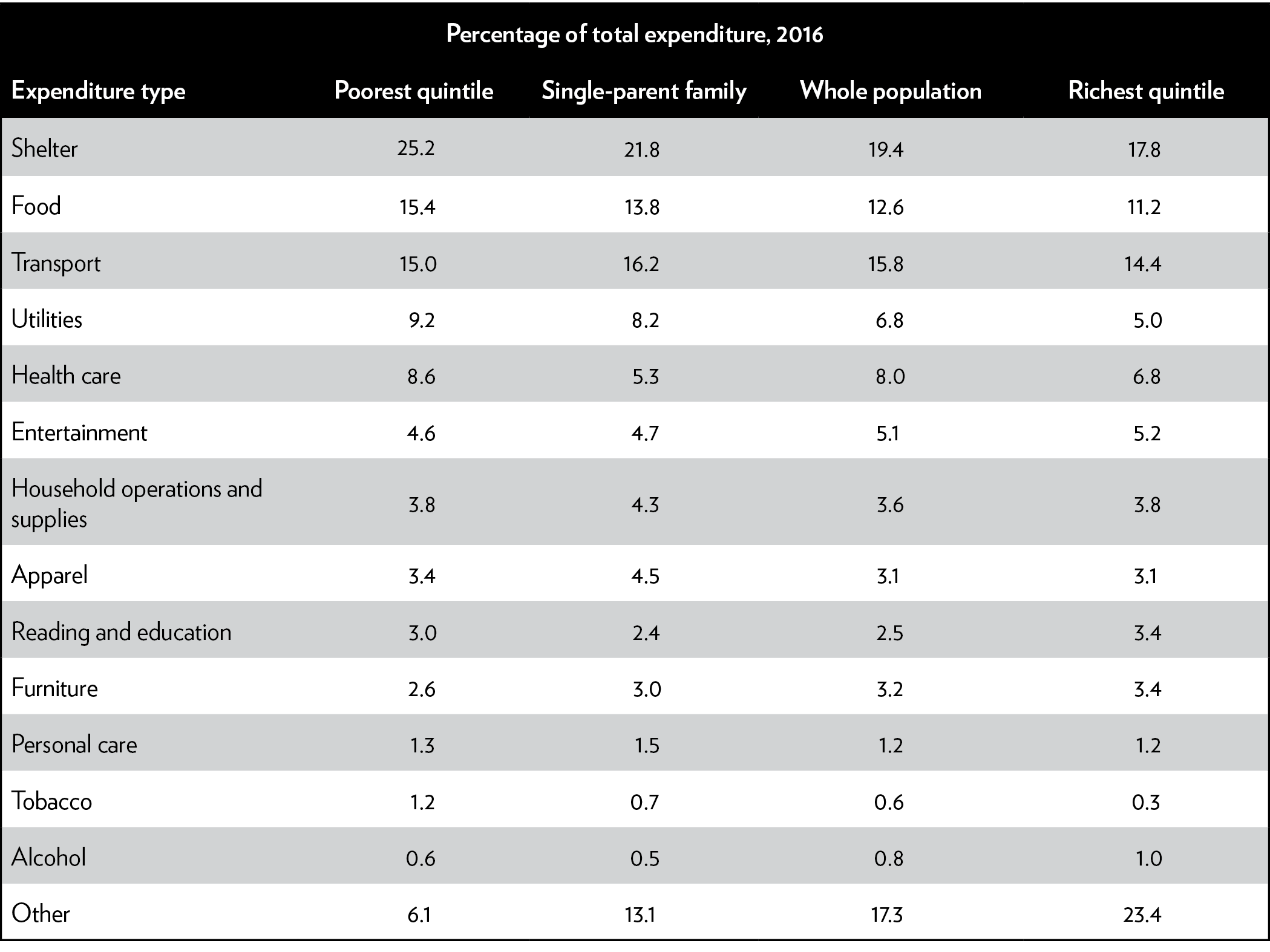

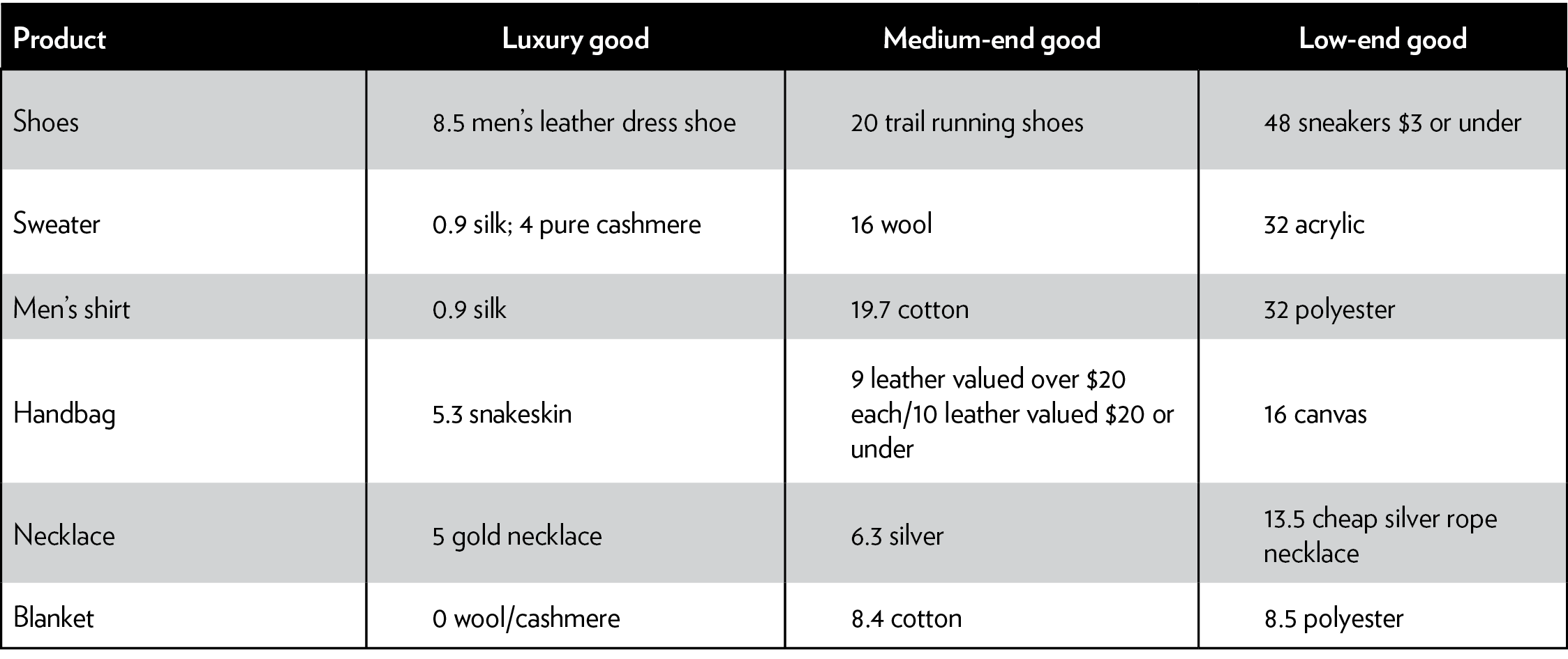

U.S. consumers pay the price of this protectionism, and poorer consumers especially. In fact, protectionism is doubly regressive. Not only do poorer households spend relatively more on clothes and footwear, but Edward Gresser’s work has shown how often luxury clothes and shoes face lower tariff rates than inexpensive products.105

Consider Table 3 (an updated version of Gresser’s work) below. Where duties are applicable, a pure cashmere sweater import incurs a 4 percent tariff, a wool sweater a 16 percent tariff, and an acrylic sweater a whopping 32 percent. Men’s silk shirts would see a 0.9 percent tariff, cotton shirts a 19.7 percent tariff, and cheaper polyester shirts a 32 percent tariff. Leather dress shoes have an 8.5 percent tariff, whereas cheap sneakers would see a 43 percent tariff. Windbreakers, leggings, tank tops, and other clothes made cheaply from synthetic fabrics face a 32 percent tariff if sourced from countries that the United States does not have a free-trade agreement with.

Table 3: Regressive tariffs (percentage on various goods)

Source: United States International Trade Commission, Tariff Database,

https://dataweb.usitc.gov/scripts/tariff.aspNote: The codes needed to find tariff rates for these products are: 64035960, 64029142, 64029160, 61109010/61101210, 61103030, 61059040, 61051000, 61052020, 71131921, 71131110, 71131120, 63012000, 63013000.

Assuming poorer households tend to buy cheaper products, these differential tariffs have perniciously regressive effects. (And not just for clothes; as Table 3 shows, similar trends are seen for consumer goods such as handbags, necklaces, and blankets).

It is difficult to calculate the true overall cost of these tariffs to poor families. That would require detailed information on the effect on domestic substitute goods prices, knowledge of products bought by poor families and their propensity to import in the absence of protectionism.

Nevertheless, we can develop cautious lower-bound estimates of the financial cost. The average household in the poorest income quintile spends $655 on apparel and $206 on footwear per year. Assuming the import propensities for the population as a whole apply to poorer people implies $595 of apparel spending and $199 of footwear spending is on imported goods. Taking average effective tariff rates for apparel and footwear for this spending (13.7 and 11.3 percent) implies a combined direct tariff cost of $92 per year for the average household in the poorest income quintile, or $204 per year for the average single-parent household.106

These figures underestimate the true burden, though, because they only represent the direct cost from current spending on imported goods. They assume tariffs do not raise domestically produced goods prices, though in reality the anti-competitive effect of the tariffs would be expected to raise prices here too. The calculation also assumes the same effective tariff rates for apparel and footwear apply for the poorest households as for the whole population, but we have seen that products that the poor are more likely to buy tend to face higher tariff rates. Consumer welfare losses from tariffs are higher than the implied savings here, of course, since tariffs make consumers less willing to buy imported products that they would otherwise prefer.

Nevertheless, these figures correspond well to calculations by Jason Furman, Katheryn Russ, and Jay Shambaugh that provide an estimate of the overall tariff burden (all goods, not just apparel and footwear) of around $100 and $238 per year for poorer and single-parent households, respectively.107

State governments regulate numerous occupations through education, training, or test requirements, creating barriers to entry to practicing a trade. This restricts the supply of providers within the state and discourages movement of professionals across state lines, raising the price of services.

Licensing gets justified on grounds of imperfect information between buyer and seller, particularly when harm could result from low-quality service. This argument is most forcefully made about medical professionals, where it is argued that “quack” practitioners might do substantial harm to patients. Yet restrictions on entry come with tradeoffs, including higher prices and deterring talented people from entering a profession. Ideally, one must weigh up any benefits of reduced quackery against these supply-restricting consequences.

Other sectors commonly licensed include hair braiding, barbers, and sign-language interpreters, where any costs associated with low-quality providers are likely much smaller. In these cases, consumers are best placed to judge a price-quality bundle, and intermediate institutions such as online rating sites can provide information about the nature and quality of service. Markets may even deliver certification mechanisms for safety- or quality-sensitive customers. Instead, licensure boards are often dominated by existing providers with a vested interest against competition. The arguments that licensure corrects for some “market failure” are therefore increasingly difficult to justify. Yet 25 to 30 percent of Americans now work in licensed occupations.108

A plethora of research has found licensure raises wages in licensed sectors (relative to no licensure or no certification). A recent study found that “having a license when it is not required has no influence on wage determination, but, when it is required, licensing raises wages by 7.5 percent,” even controlling for a host of worker and occupational characteristics.109

Whether this raises prices depends on whether consumers would demand equally robust entry barriers in the form of certification absent government intervention. Without licensure constraints, prices of services are likely to be lower, unless state governments provide economies of scale in license provision relative to private certificates. However, in many cases consumers are unlikely to demand substitute certification at all, and so the wage premium would evaporate.

Research on individual markets confirms this intuition. Relaxing licensing laws to allow nurse practitioners to perform tasks without medical doctor supervision was found to reduce well-child exam prices by between 3 and 16 percent.110 Delicensing of funeral servicing providers in Colorado lowered funeral prices significantly.111 Older papers estimated that dental assistant and hygienist licensing raised prices of dental visits by between 7 and 11 percent, and optician licensing the price of eye care by between 5 and 13 percent.112

Two attempts have been made to estimate the aggregate costs of occupational licensing to consumers. Morris Kleiner, Alan Krueger, and Alex Mas estimated a $203 billion annual cost, or $1,567 per household.113 The Heritage Foundation’s Salim Furth estimates a lower figure, with a cost to the average household of $1,033 per year.114

Ideally, we would produce a more accurate estimate using detailed data of the cost of licensure by sector mapped against spending patterns for poor households. We know, for example, that poorer households spend relatively more on health care than richer households but also that richer households spend more on other grooming services affected by the licensure premium. Poorer households are likely to be more price sensitive and less discerning about “quality.” One must bear in mind, too, that because licensing restricts people from practicing certain occupations, the potential labor supply is increased in nonlicensed sectors, putting downward pressure on labor costs and hence prices in other industries.

Bearing these caveats in mind, I assume that the total spending ratio of poorer and single-parent households to the average household is the same as the ratio of spending on licensed services between the groups. Using the household costs of licensure from Kleiner and Furth implies an average annual cost to poorer households of between $450 and $690 per year, and between $760 to $1,160 per year for the average single-parent household.115 Again, this is a lower bound to the true economic costs for poorer people, not least because occupational entry barriers prevent individuals from taking up new and better job opportunities because of the time and financial costs of meeting the licensure requirements.

This paper has demonstrated how government interventions raise the cost of living for poor and single-parent households.

Debates on policies to help the poor tend to focus on redistribution, tax breaks, minimum wage hikes, and government-provided services. But liberalizing reform in the markets outlined above could improve the financial well-being of less well-off households without new government expenditure or risky labor-market interventions. A “cost-based” approach to poverty alleviation should be considered a key tool in helping the less well-off.

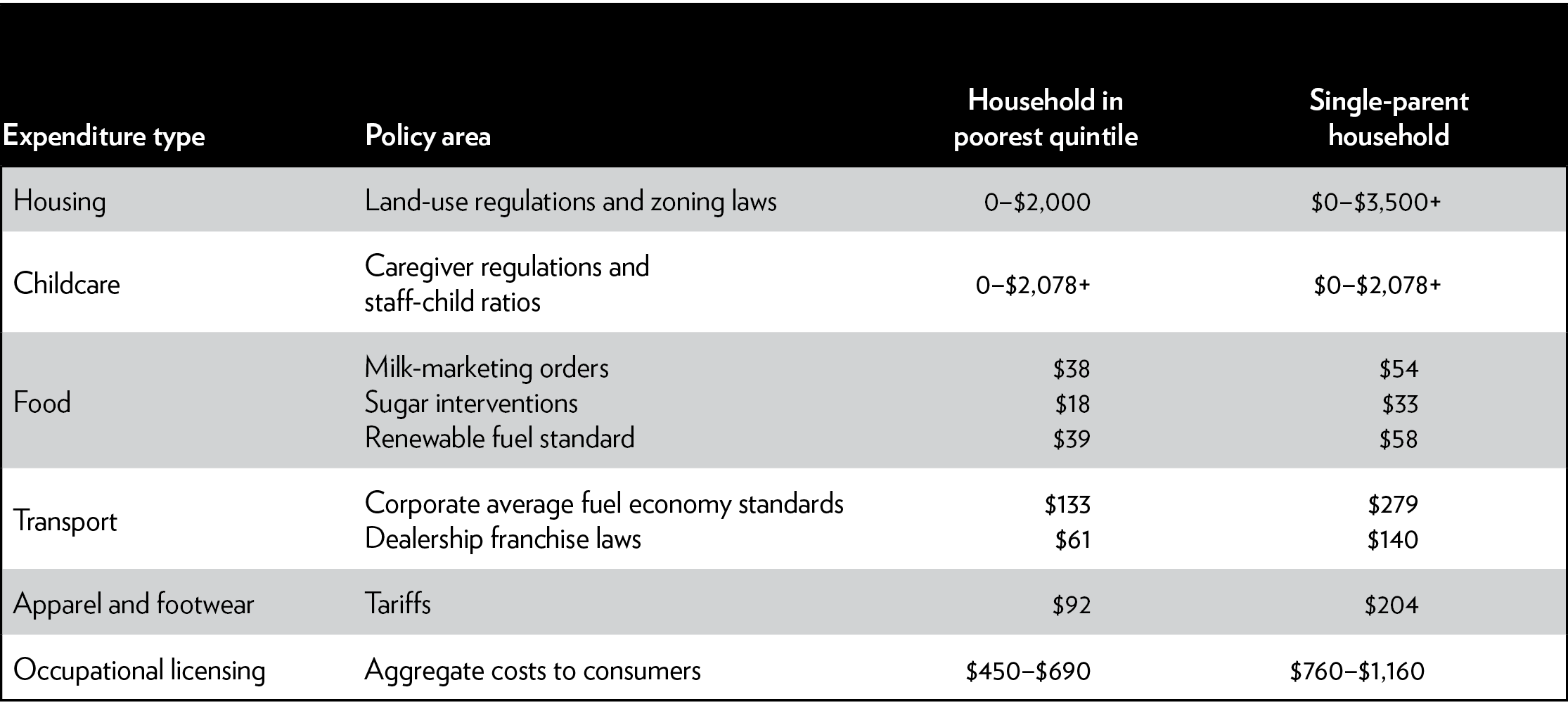

Table 4 summarizes the estimated direct costs to poorer and single-parent households of existing interventions. These are based on extremely cautious assumptions and likely understate the true financial impacts. The ranges are wide, reflecting differences in household location and composition. However, a reasonable central range for poorer households would be a lower bound cost of $830 per year for a household with no children living in a rural area, up to $3,500 for a poor family living in an expensive city such as New York with a young child in full-time infant care.116

Table 4: Summary of costs of interventions on the poor and single parents (dollars per year)

Source: Author’s calculations applied largely through the Bureau of Labor Statistics Consumer Expenditure Survey,

https://www.bls.gov/cex/.

Note: Housing costs range from areas with no effective regulatory tax through to the implied regulatory tax in expensive cities (adjusted to relative spending by poor and single-parent households). Child-care costs range from $0 for those with no young children in infant care to the implied savings from relaxing staff-child ratios by one child in the most expensive region for childcare (D.C.). Milk-marketing order costs calculated using information from Chouinard et al. Sugar program costs calculated applying per person midpoint cost of Beghin and Elobeid cost estimate, multiplied by average household numbers for poor and single-parent families. Renewable food standard cost based on 1 percent uplift in food prices applied to food spending levels. Corporate average fuel economy standards cost calculated as 10 percent increase in vehicle prices applied to vehicle purchase spending levels. Dealership franchise laws cost assumes new vehicle prices are increased by 6 percent and used car prices by 4 percent as a result of the regulations. Tariff costs estimated on current spending levels by poor and single-parent households, based on whole population import propensities and average effective tariff rates on apparel and footwear. Occupational licensing costs based on the average cost of licensure per household estimates from Kleiner et al. and Furth adjusted for spending levels of the poor and single parents. For more information on the assumptions behind these calculations, see the discussion in relevant sections of the paper.

The figures here relate only to the direct effects of these policies on prices and so ignore the broader effect on productivity and market incomes. For land-use and zoning laws, child-care regulations, policies that increase driving costs, and occupational licensure these secondary effects could be very large indeed. Liberalization could improve labor mobility, willingness to move into the labor market, and job options available to the unemployed and existing low-paid workers.

The calculations are cautious for other reasons. Estimates of the cost of sugar interventions and tariffs on clothing and footwear assume that the poor have the same consumption habits as the broader population, though there are reasonable grounds to suspect the cost borne by them is even higher. The cost of child-care regulations is pegged at the savings from very modest relaxation of existing staffing regulations, rather than full repeal, which could deliver huge price reductions. This analysis also ignores regressive interventions in other areas where the poor spend significant amounts, especially health care and utilities.

Individual households will face very different costs depending on exactly where they live, whether they have young children, their means of transportation, and other spending tastes and preferences. This paper has shown, though, that a “cost-based” reform agenda could deliver major financial savings for poor families.

A concerted anti-poverty agenda across all levels of government overturning these damaging policies could have political benefits too. The lower cost of living would lessen political demands for government to redistribute income. The aspirations of the “living wage” campaign would be much more likely to be achieved, but through lower living costs rather than demands for states or cities to raise minimum wages. Better financial outcomes for the poor through market activity might lead to greater support for economic liberalization in other sectors.

Reform would be politically challenging. But with the federal finances suffering from large and growing imbalances and widespread concern about the future of labor markets, now is an opportune time for a new approach to assist those on low incomes. For too long an obsessive focus on the role of government transfers and minimum wage laws in alleviating poverty has blinded campaigners and politicians to areas where existing policies raise living costs. We should aspire to undo this damage, rather than doubling down on a more interventionist agenda that, in part, seeks to treat the symptoms of current mistakes.

1. Michael Tanner, “The American Welfare State: How We Spend Nearly $1 Trillion a Year Fighting Poverty—and Fail,” Cato Institute Policy Analysis no. 694, April 11, 2012, https://www.cato.org/publications/policy-analysis/american-welfare-state-how-we-spend-nearly-%241-trillion-year-fighting-poverty-fail.

2. See discussion of theories of causes of poverty in Michael Tanner, The Inclusive Economy: How to Bring Wealth to America’s Poor, Cato Institute, forthcoming, December 2018.

3. Sean Higgins, “Democrats Officially Introduce $15 Minimum Wage Bill,” Washington Examiner, May 25, 2017.

4. See “A Living Wage,” BernieSanders.com, https://berniesanders.com/issues/a-living-wage/; and “Early Childhood Education,” HillaryClinton.com, https://www.hillaryclinton.com/issues/early-childhood-education/.

5. Ryan Bourne, “A Jobs Guaranteed Economic Disaster,” Cato at Liberty, Cato Institute, April 24, 2018, https://www.cato.org/blog/jobs-guaranteed-economic-disaster.

6. Dylan Matthews, “Hillary Clinton Almost Ran for President on a Universal Basic Income,” Vox.com, September 12, 2017; see also Charles Murray, “A Guaranteed Income for Every American,” Wall Street Journal, June 3, 2016.

7. Ramesh Ponnuru, “Tax Relief for Parents,” Statement before the Senate Committee on Finance on “Individual Tax Reform,” September 14, 2017, http://www.aei.org/publication/tax-relief-for-parents/; and Sen. Mike Lee, “Sens. Lee and Rubio to Introduce Child Tax Credit Refundability Amendment,” November 29, 2017, https://www.lee.senate.gov/public/index.cfm/2017/11/sens-lee-and-rubio-to-introduce-child-tax-credit-refundability-amendment.

8. “A Better Way: Our Vision for a Confident America,” Poverty, Opportunity, and Upward Mobility, June 7, 2016, https://abetterway.speaker.gov/_assets/pdf/ABetterWay-Poverty-PolicyPaper.pdf.

9. For example, it is widely acknowledged that policies that seek to ameliorate climate change by raising the cost of carbon emissions hit the poor hard. But the objective of these policies is to internalize the social costs of carbon, which theoretically raises overall economic efficiency. Though one can debate whether existing policies do this well, or whether they are needlessly regressive, this paper avoids issues where these kinds of judgments are required, instead focusing on areas where market failure arguments are weak and the policies have clear regressive effects.

10. Arloc Sherman, “Official Poverty Measure Masks Gains Made over Last 50 Years,” Center for Budget and Policy Priorities, September 13, 2013, https://www.cbpp.org/research/official-poverty-measure-masks-gains-made-over-last-50-years.

11. Bruce D. Meyer and Derek Wu, “The Poverty Reduction of Social Security and Means-Tested Transfers,” NBER Working Paper no. 24567, May 2018, http://www.nber.org/papers/w24567.

12. David Neumark, “Reducing Poverty via Minimum Wages, Alternatives,” Federal Reserve Bank of San Francisco Economic Letter no. 2015-38, December 28, 2015, https://www.frbsf.org/economic-research/publications/economic-letter/2015/december/reducing-poverty-via-minimum-wages-tax-credit/.

13. Bruce Meyer and James Sullivan, “Winning the War: Poverty from the Great Society to the Great Recession,” Brookings Papers on Economic Activity, Fall 2012, https://www.brookings.edu/wp-content/uploads/2012/09/2012b_Meyer.pdf.

14. Congressional Budget Office, The Budget and Economic Outlook: 2018 to 2028, April 2018.

15. Congressional Budget Office, The 2017 Long-Term Budget Outlook, March 2017.

16. See Karel Martens and José L. Montiel Olea, “Marginal Tax Rates and Income: New Times Series Evidence,” NBER Working Paper no. 19171, September 2017, http://www.nber.org/papers/w19171; and Robert J. Barro and Charles J. Redlick, “Macroeconomic Effects from Government Purchases and Taxes,” NBER Working Paper no. 15369, December 2011, http://www.nber.org/papers/w15369. Concerning the latter, Barro states in the Wall Street Journal that “My research with Charles Redlick, published in 2011 by the Quarterly Journal of Economics, suggests that cutting the average marginal tax rate for individuals by 1 percentage point increases gross domestic product by 0.5% over the next two years.” Robert J. Barro, “Tax Reform Will Pay Growth Dividends,” Wall Street Journal, January 4, 2018.

17. See David Neumark and Cortnie Shupe, “Declining Teen Employment: Minimum Wages, Other Explanations, and Implications for Human Capital Investment,” Mercatus Center Working Paper, February 7, 2018, https://www.mercatus.org/publications/declining-teen-employment-minimum-wage-human-capital-investment.

18. See summary of the literature in Ryan Bourne, “A Seattle Game-Changer?,” Regulation 40, no. 4 (Winter 2017–2018): 8–11, https://object.cato.org/sites/cato.org/files/serials/files/regulation/2017/12/regulation-v40n4-6.pdf.

19. Neil Irwin, “The Unemployment Rate Rose for the Best Possible Reason,” New York Times, July 6, 2018.

20. In Britain, working-age welfare bore a hugely disproportionate share of the deficit reduction measures seen following the general election during 2010.

21. Andrew Hall and Jesse Yoder, “Does Homeownership Influence Political Behavior? Evidence from Administrative Data,” Department of Political Science, Stanford University, August 7, 2018.

22. Bureau of Labor Statistics, Consumer Expenditure Survey, Metropolitan Statistical Area Tables, https://www.bls.gov/cex/tables.htm#MSA.

23. Child Care Aware of America, “2017 Appendices: Parents and the High Cost of Child Care,” http://usa.childcareaware.org/costofcare.

24. The costs to the average poor household of anti-competitive, regressive regulations would be higher still if we also examined some utilities and health care interventions; but that is beyond the scope of this paper.

25. Pew Charitable Trusts, “Household Expenditures and Income,” March 2016. The poorest quintile are more likely to be renters: 61 percent of households in the bottom quintile and 66 percent of single-parent households rent, compared to just 15 percent of households in the top income quintile; see Bureau of Labor Statistics, Consumer Expenditure Survey 2016, Table 1101, Quintiles of income before taxes, and Table 1502, Composition of consumer unit.

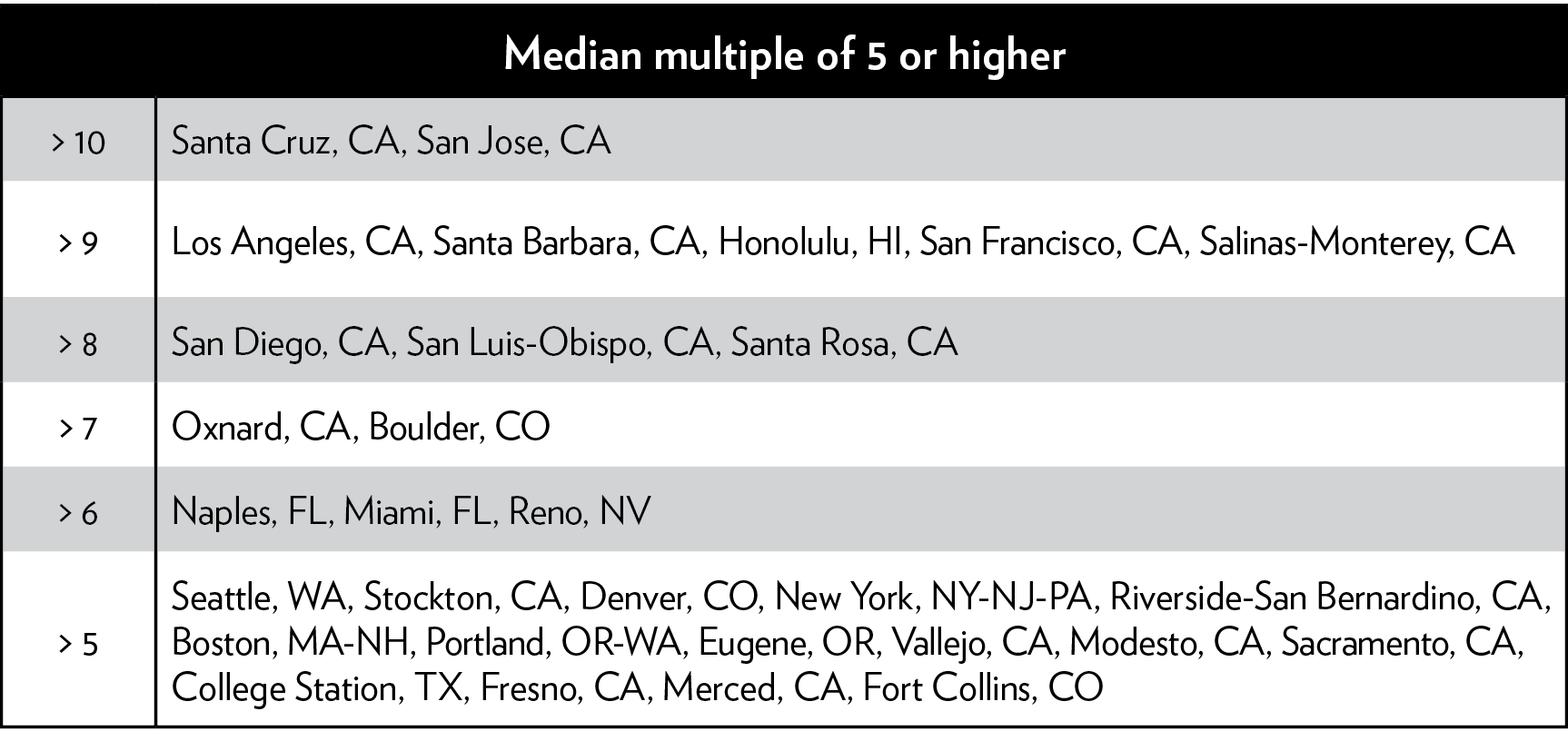

26. Demographia, “14th Annual Demographia International Housing Affordability Survey: 2018,” January 22, 2018, http://demographia.com/dhi.pdf. It is worth noting that Demographia limits its analysis to metropolitan areas with populations of 1 million people or more.

27. Crystal Chen, “Zumper National Rent Report: March 2018,” Zumper.com, February 28, 2018.

28. Edward L. Glaeser, Joseph Gyourko, and Raven Saks, “Why Is Manhattan So Expensive? Regulation and the Rise in Housing Prices,” Journal of Law and Economics 48, no. 2 (October 2005): 331–69.

29. Vanessa Brown Calder, “Zoning, Land-Use Planning, and Housing Affordability,” Cato Institute Policy Analysis no. 823, October 18, 2017, https://www.cato.org/publications/policy-analysis/zoning-land-use-planning-housing-affordability.

30. Stephen Malpezzi, “Housing Prices, Externalities, and Regulation in U.S. Metropolitan Areas,” Journal of Housing Research 7, no. 2 (1996): 209–41.

31. Raven Saks, “Job Creation and Housing Construction: Constraints on Metropolitan Area Employment Growth,” Finance and Economics Discussion Series, Divisions of Research and Statistics and Monetary Affairs, Federal Reserve Board, Working Paper no. 2005-49, September 22, 2005.

32. Keith R. Ihlanfeldt, “The Effect of Land Use Regulation on Housing and Land Prices,” Journal of Urban Economics 61, no. 3 (May 2007).

33. Chang-Tai Hsieh and Enrico Moretti, “Why Do Cities Matter? Local Growth and Aggregate Growth,” Econometrics Laboratory, University of California, Berkeley, Working Paper, April 2015.

34. Rebecca Diamond, Timothy McQuade, and Franklin Qian, “The Effects of Rent Control Expansion on Tenants, Landlords, and Inequality: Evidence from San Francisco,” NBER Working Paper no. 24181, January 2018, http://www.nber.org/papers/w24181.

35. Vanessa Brown Calder, “Zoning, Land-Use Planning, and Housing Affordability.”

36. Bureau of Labor Statistics, Consumer Expenditure Survey 2016, Tables 3004, 3024, and 3033.

37. Jordan Weissman, “So You’re Rich for an American. Does That Make You Rich for New York?” Slate Moneybox, August 29, 2014.

38. Calculation by author subtracting Glaeser et al. estimate of implied regulatory tax for New York (12.2 percent) from average New York household expenditure on shelter of $16,882 in 2016 (taken from Consumer Expenditure Survey 2016, Table 3004). This implies regulation raises average household expenditure by $1,836 per year. Given those in the poorest quintile, on average, spend 57 percent of average household expenditure on shelter across the whole of the United States (Consumer Expenditure Survey 2016, Table 1101), this suggests these households pay $1,044 more for shelter than they would if the regulatory tax was zero.

39. Child Care Aware of America, “2017 Appendices: Parents and the High Cost of Child Care,” Appendix I: 2016 Average Annual Cost of Full-Time Center-Based Child Care by State, http://usa.childcareaware.org/costofcare.

40. Child Care Aware of America, “2017 Appendices: Parents and the High Cost of Child Care,” Appendix III: 2016 Ranking of Least-Affordable Center-Based Infant Care, http://usa.childcareaware.org/costofcare.

41. Dawn Lee, “State Child Care Assistance Programs,” Single Mother Guide, January 10, 2018, https://singlemotherguide.com/state-child-care-assistance/.

42. OECD, Society at a Glance 2016: OECD Social Indicators (Paris: OECD Publishing, 2016), Figure 1.14. Childcare costs are around 15% of net family income across the OECD. Out-of-pocket childcare costs for a single parent: full-time care at a typical childcare center, http://dx.doi.org/10.1787/9789264261488-en.

43. Rachel Connelly and Jean Kimmel, “The Effect of Child Care Costs on the Employment and Welfare Recipiency of Single Mothers,” Southern Economic Journal 69, no. 3 (January 2003): 498–519, https://www.jstor.org/stable/1061691?seq=1#page_scan_tab_contents.

44. Allison Linn, “Opt Out or Left Out? The Economics of Stay-at-Home Moms,” NBC News, May 12, 2013.

45. Lynda Laughlin, “Who’s Minding the Kids? Childcare Arrangements: Spring 2011.” U.S. Census Bureau Current Population Reports no. P70-135, April 2013. Among children with employed mothers, those living below the poverty line were more than twice as likely to be cared for by an unlicensed relative (20.7 percent vs. 9 percent).

46. Author’s calculations based on data from U.S. Bureau of Labor Statistics, “Women in the Labor Force: A Databook,” BLS Report no. 1071, November 2017, https://www.bls.gov/opub/reports/womens-databook/2017/pdf/home.pdf.

47. Ryan Bourne and Len Shackleton, “Getting the State out of Preschool and Childcare,” Institute of Economic Affairs, February 6, 2017, https://iea.org.uk/publications/getting-the-state-out-of-pre-school-childcare/.

48. Diana Thomas and Devon Gorry, “Regulation and the Cost of Child Care,” Mercatus Center Working Paper, August 17, 2015.

49. Randal Heeb and M. Rebecca Kilburn, “The Effects of State Regulations on Childcare Prices and Choices,” RAND Labor and Population Working Paper no. WR-137-NICHD, January 2004, https://www.rand.org/content/dam/rand/pubs/working_papers/2004/RAND_WR137.pdf.

50. V. Joseph Hotz and Mo Xiao, “The Impact of Regulations on the Supply and Quality of Care in Child Care Markets” American Economic Review 101, no. 5 (August 2011): 1775–1805.

51. Nicholas Clairmont, “D.C.’s Misguided Attempt to Regulate Daycare,” Atlantic, July 11, 2017.

52. Martin Austermuhle, “D.C. Delays New Degree Requirements for Childcare Workers,” WAMU, November 17, 2017.

53. Author’s calculation applying Thomas and Gorry’s lower bound estimate of price fall from loosening staff-child ratios by one across the board (9 percent) to the average annual cost of the most expensive care in the country (D.C. at $23,089 per year) and the cheapest (Mississippi at $5,178). This implies prices would fall by around $2,078 in DC and $466 in Mississippi, assuming a linear relationship.

54. Ryan Bourne and Len Shackleton, “Getting the State out of Preschool and Childcare.”

55. Though not analyzed here, it is likely that the cost of childcare is also pushed up by other, broader government policies which have damaging economic consequences. Zoning and land-use ordinances quite often prohibit new facilities in residential areas, and home daycare has to comply with requirements on lot size, parking, and architectural regulations. Barriers to immigration from poorer countries also restrict the supply of lower-cost child-care workers.

56. Chris Edwards, “Milk Madness,” Cato Institute Tax and Budget Bulletin no. 47, July 2007, https://www.cato.org/publications/tax-budget-bulletin/milk-madness.

57. Owen Townsend, Kenneth Burdine, and Tyler Mark, “The History and Class Pricing of Federal Milk-Marketing Orders,” University of Kentucky Department of Agricultural Economics, Agricultural Economics Extension Series Number: 2017-13, https://www.uky.edu/Ag/AgEcon/pubs/extfedmilkord06.pdf.

58. Hayley Chouinard et al., “Milk Marketing Order Winners and Losers,” Applied Economic Perspectives and Policy 32, no. 1 (March 2010): 59–76.

59. The averaged data are calculated by Chouinard et al., “Milk Marketing Order Winners and Losers.”

60. Bureau of Labor Statistics, Consumer Expenditure Survey 2016, Table 1101, Quintiles of income before taxes.

61. Bureau of Labor Statistics, Consumer Expenditure Survey 2016, Table 1502, Composition of consumer unit: Annual expenditure means, shares, standard errors, and coefficients of variation.

62. Calculated by author. Based on a regulatory cost of $44 for a white household earning $10,000 and $38 for a household earning $20,000, a straight-line extrapolation suggests the cost to a household with average income for the quintile ($11,363) would be $43. Assuming this cost holds for all nonblack households, and that the burden is one-third of this for black households, one can use the proportion of black to nonblack households in the bottom quintile (20:80) to calculate the overall average regulatory burden for the quintile (80% x $43 + 20% x $14) = $37.51. Given that we know the ratio of spending by the average single-parent household to the average household in the poorest quintile on dairy is 1.43, the average regulatory cost for single-parent households can be estimated $37.51 x 1.43 = $54.31.

63. Colin Grabow, “Candy-Coated Cartel: Time to Kill the U.S. Sugar Program,” Cato Institute Policy Analysis no. 837, April 10, 2018, https://www.cato.org/publications/policy-analysis/candy-coated-cartel-time-kill-us-sugar-program.

64. U.S. Department of Agriculture Economic Research Service, “Sugar and Sweeteners,” https://www.ers.usda.gov/topics/crops/sugar-sweeteners/.

65. Michael K. Wohlgenant, “Sweets for the Sweet: The Costly Benefits of the U.S. Sugar Program,” American Enterprise Institute, July 12, 2011.

66. John C. Beghin and Amani Elobeid, “Analysis of the US Sugar Program,” Agricultural Policy in Disarray: Reforming The Farm Bill, American Enterprise Institute, November 2017, http://www.aei.org/publication/analysis-of-the-us-sugar-program/.

67. This number is calculated by dividing the $2.8 billion and $4.7 billion range of consumer cost by 129.55 million household units, as per Table 1101 of the Consumer Expenditure Survey.

68. Elyse S. Powell, Lindsey P. Smith-Taillie, and Barry M. Popkin, “Added Sugars Intake across the Distribution of US Children and Adult Consumers: 1977–2012,” Journal of the Academy of Nutrition and Dietetics 116, no. 10 (October 2016): 1543–50.

69. Congressional Budget Office, “The Impact of Ethanol Use on Food Prices and Greenhouse-Gas Emissions,” April 2009, https://www.cbo.gov/publication/41173, pp. 8–10.

70. Richard K. Perrin, “Ethanol and Food Prices—Preliminary Assessment,” Faculty Publications: Agricultural Economics 49, University of Nebraska–Lincoln, May 9, 2008.

71. Congressional Budget Office, “The Renewable Fuel Standard: Issues for 2014 and Beyond,” June 2014, https://www.cbo.gov/publication/45477.

72. Calculations by author based on food expenditure data from Table 1101, Quintiles of income before taxes, and Table 1502, Composition of consumer unit, from Consumer Expenditure Survey.

73. Bureau of Labor Statistics, Consumer Expenditure Survey 2016, Table 1101, Quintiles of income before taxes.

74. U.S. Census Bureau, 2012–2016 American Community Survey 5-Year Estimates, DP04 Selected Housing Characteristics.

75. Daniel C. Vock, “More Poorer Residents Are Driving Cars, Presenting New Issues for Transit Agencies,” Governing.com, April 9, 2018, http://www.governing.com/topics/transportation-infrastructure/gov-car-ownership-poverty.html.

76. Lisa M. Brabo et al., “Driving Out of Poverty in Private Automobiles,” Journal of Poverty 7, no. 1-2 (2003): 183–96, https://www.researchgate.net/publication/239804081_Driving_Out_of_Poverty_in_Private_Automobiles.

77. For a summary of recent research, see Peter Van Doren, “Regulation without Results,” U.S. News and World Report, March 27, 2017.

78. Timothy Puko, Mike Spector, and Chester Dawson, “EPA Will Ease Vehicle-Emissions Standards,” Wall Street Journal, April 2, 2018.

79. Timothy Puko, “Trump Administration May Eliminate Increases in Fuel-Economy Standards,” Wall Street Journal, April 27, 2018.

80. For a full exposition of this argument, read Arik Levinson, “Energy Efficiency Standards Are More Regressive Than Energy Taxes: Theory and Evidence,” May 8, 2018, http://faculty.georgetown.edu/aml6/pdfs&zips/RegressiveMandates.pdf. Empirical evidence at Lucas W. Davis and Christopher R. Knittel, “Are Fuel Economy Standards Regressive?” NBER Working Paper no. 22925, December 2016, http://www.nber.org/papers/w22925 and Mark R. Jacobsen, “Evaluating US Fuel Economy Standards in a Model with Producer and Household Heterogeneity,” American Economic Journal 5, no. 2 (May 2013): 148–87, https://www.aeaweb.org/articles?id=10.1257/pol.5.2.148.

81. Davis and Knittel, “Are Fuel Economy Standards Regressive?”

82. Adjusted by Consumer Price Index for All Urban Consumers: All Items. Federal Reserve Economic Data, Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/series/CPIAUCSL.

83. Mark R. Jacobsen, “Evaluating US Fuel Economy Standards in a Model with Producer and Household Heterogeneity.”

84. Calculations averaging standards in 2011, 2018, and 2025, assuming two-thirds of vehicles are ordinary cars and one-third light trucks. This would see average miles-per-gallon standards increase from 28.3 in 2011 to 38.3 in 2018, and then further to 50 by 2025.

85. David L. Greene, “Short-Run Pricing Strategies to Increase Corporate Average Fuel Economy,” Economic Inquiry 29, no. 1 (January 1991): 101–14. Paper shows for every one-mile-per-gallon increase in vehicle fuel economy, the average per-vehicle cost would be within the range of $100 to $200 in constant 1985-dollar terms, adjusted to 2018 prices. For a more detailed review of the literature see Thomas Klier and Joshua Linn, “Corporate Average Fuel Economy Standards and the Market for New Vehicles,” Annual Review of Resource Economics 3, no. 1 (October 2011): 445–62.

86. Rob Looker, “Average New- and Used-Car Prices, and the Advantages of Flexible Financing,” RoadLoans.com, March 1, 2018, https://roadloans.com/blog/average-car-price.

87. Net outlay on vehicle purchases averages $1,331 per year for the average household in the poorest quintile in 2016.

88. Mark R. Jacobsen and Arthur A. van Bentham, “Vehicle Scrappage and Gasoline Policy,” NBER Working Paper no. 19055, May 2013, http://www.nber.org/papers/w19055.

89. David Austin and Terry Dinan, “Clearing the Air: The Costs and Consequences of Higher CAFE Standards and Increased Gasoline Taxes,” Journal of Environmental Economics and Management 50, no. 3 (November 2005): 562–82, https://www.sciencedirect.com/science/article/pii/S0095069605000550.

90. Julian Morris, “The Effect of Corporate Average Fuel Economy Standards on Consumers,” Reason Foundation Policy Brief, April 1, 2018, https://reason.org/policy-brief/the-effect-of-corporate-average-fuel-economy-standards-on-consumers/.

91. For a more comprehensive examination of these issues, see Francine Lafontaine and Fiona Scott Morton, “State Franchise Laws, Dealer Terminations, and the Auto Crisis,” Journal of Economic Perspectives 24, no. 3 (Summer 2010): 233–50, StateFranchiseLawsDealerTerminationsandtheAutoCrisis.pdf">http://faculty.som.yale.edu/FionaScottMorton/documents/StateFranchise">StateFranchiseLawsDealerTerminationsandtheAutoCrisis.pdf.

92. Richard L. Smith II, “Franchise Regulation: An Economic Analysis of State Restrictions on Automobile Distribution,” Journal of Law and Economics 25, no. 1 (April 1982): 150.

93. Robert P. Rogers, “The Effect of State Entry Regulation on Retail Automobile Markets,” Bureau of Economics Staff Report to the Federal Trade Commission, January 1986.

94. Mark Cooper, “A Roadblock on the Information Superhighway: Anticompetitive Restrictions on Automotive Markets,” Consumer Federation of America, February 2001, https://consumerfed.org/pdfs/internetautosales.pdf.

95. Brian Shaffer, “An Assessment of Franchise Laws and Internet Auto Sales,” National Automobile Dealers Association Public Affairs, August 2001.

96. See, for example, Frank Mathewson and Ralph Winter, “The Economic Effects of Automobile Dealer Regulation,” Annales d’Économie et de Statistique, no. 15/16 (July–December 1989): 409–26, http://www.jstor.org/stable/20075766; and Gerald Bodisch, “Economic Effects of State Bans on Direct Manufacturer Sales to Car Buyers,” U.S. Department of Justice Economic Analysis Group, May 2009, http://www.justice.gov/atr/economic-effects-state-bans-direct-manufacturer-sales-car-buyers.

97. Assumes new vehicle prices are increased by 6 percent and used car prices by 4 percent as a result of the regulations. Average spending on new cars and trucks is $462 and $843 on used for those in the lowest quintile. This implies the cost of the regulations for the average household in the poorest quintile is $27.72 and $33.72 on new and used vehicles, respectively, summing to $61.44; for the average single-parent household these figures are $55.74 and $84.60, summing to $140.34.

98. Bureau of Labor Statistics, Consumer Expenditure Survey 2016, Table 1101, Quintiles of income before taxes.

99. Bureau of Labor Statistics, Consumer Expenditure Survey 2016, Table 1502, Composition of consumer unit.

100. U.S. International Trade Commission, “Interactive Tariff and Trade DataWeb,” at http://dataweb.usitc.gov. Data for imports for consumption, and effective rates calculated using “customs value” and “calculated duties” for 2017.

101. See, for example, Daniel Ikenson, “Threadbare Excuses: The Textile Industry’s Campaign to Preserve Import Restraints,” Cato Institute Trade Policy Analysis no. 25, October 15, 2003, https://www.cato.org/publications/trade-policy-analysis/threadbare-excuses-textile-industrys-campaign-preserve-import-restraints; and Ikenson, “Cutting the Cord: Textile Trade Policy Needs Tough Love,” Cato Institute Free Trade Bulletin no. 15, July 23, 2013, https://www.cato.org/publications/free-trade-bulletin/cutting-cord-textile-trade-policy-needs-tough-love.

102. Jason Furman, Katheryn Russ, and Jay Shambaugh, “U.S. Tariffs Are an Arbitrary and Regressive Tax,” Vox.com, CEPR’s Policy Portal, January 12 2017, https://voxeu.org/article/us-tariffs-are-arbitrary-and-regressive-tax. See in particular Technical Appendix to the CEX-HS Crosswalk and Matched Effective Tariffs.

103. Federal Reserve Economic Data, Federal Reserve Bank of St. Louis, All Employees: Nondurable Goods: Textile Mills, https://fred.stlouisfed.org/series/CEU3231300001.

104. Daniel Ikenson, “Washington’s Coddling of U.S. Textile Industry Is Hurting Shoppers,” Forbes, July 23, 2013.

105. Edward Gresser, “Toughest on the Poor: America’s Flawed Tariff System,” Foreign Affairs, November/December 2002.

106. The average single-parent household spends $1,402 on apparel and $512 on footwear per year. Assuming the import propensities for the population as a whole apply to single-parent households, this would mean $1,274 of apparel spending and $494 of footwear spending is on imported goods. Taking average effective tariff rates for apparel and footwear for this spending (13.7 and 11.3 percent) implies a direct cost of protectionism of $204 per year.

107. Jason Furman, Katheryn Russ, and Jay Shambaugh, “U.S. Tariffs Are an Arbitrary and Regressive Tax.”

108. National Conference of State Legislatures, “The National Occupational Licensing Database”; Morris M. Kleiner, “Reforming Occupational Licensing Policies,” Brookings Institution Discussion Paper No. 2015-01, March 2015; and Maury Gittleman, Mark Klee, and Morris Kleiner, “Analyzing the Labor Market Outcomes of Occupational Licensing,” Industrial Relations 57, no.1: 57-100.

109. Maury Gittleman, Mark Klee, and Morris Kleiner, “Analyzing the Labor Market Outcomes of Occupational Licensing.”

110. Morris M. Kleiner et al., “Relaxing Occupational Licensing Requirements: Analyzing Wages and Prices for a Medical Service,” NBER Working Paper no. 19906, February 2014.

111. Brandon Pizzola and Alex Tarrabok, “Occupational Licensing Causes a Wage Premium: Evidence from a Natural Experiment in Colorado’s Funeral Services Industry,” International Review of Law and Economics 50, issue C, 50–59, 2017.

112. Nellie J. Liang and Jonathan D. Ogur, “Restrictions on Dental Auxiliaries: An Economic Policy Analysis,” Federal Trade Commission, 1987; and Deborah Haas-Wilson, “The Effect of Commercial Practice Restrictions: The Case of Optometry,” Journal of Law & Economics 29, no. 1 (1986): 165–86.

113. Morris Kleiner, Alan B. Krueger, and Alex Mas, “A Proposal to Encourage States to Rationalize Occupational Licensing Practices,” A Proposal to the Brookings Institution Hamilton Project, April 2011, https://www.hhh.umn.edu/file/9441/download.

114. Salim Furth, “Costly Mistakes: How Bad Policies Raise the Cost of Living,” Backgrounder No. 3081, Heritage Foundation, November 23 2015.

115. Author’s calculations based on the average cost of licensure per household estimates from Kleiner et al. and Furth and adjusting for spending levels of the poor and single parents using data from the Consumer Expenditure Survey, Tables 1101 and 1502.

116. Author’s calculations using estimates outlined in Table 4. The lower estimate assumes $0 regulatory cost for housing and childcare and the lower end of the range presented for the cost of occupational licensure. The higher estimate assumes a $1,044 cost of housing regulation; a $1,350 cost of child-care regulation (using calculations for New York State from Child Care Aware of America); and the top end of the occupational licensure cost range.